Below is an interview between Peter Schiff and some typical leftoid bimbo from the Progressive Policy Institute. I was not very familiar with Schiff prior to finding this interview, but on the topic of worthless degrees I am in total agreement with him. Government guarantees are the leading cause of…

Category: Personal Finance

As I often do, I was browsing reddit when I found the following post by an apparent Singapore native who was annoyed that a bank was advertising a female only credit card… In my country, only 2 banks here offer women-only credit cards; this is one bank. It’s been around…

Words you never want to hear (surprisingly): “You just won the lottery.” I just read one of the more interesting reddit comments I have ever seen and decided to share. I recommend you read through it as well. Apparently winning large sums of money in the lottery more often than…

I am not an economist, more casual observer, but I could see why negative interest rates could become a very huge problem when combined with a cashless society. A society which some prominent economists are already calling for. Negative interest rates are already in place at multiple central banks around…

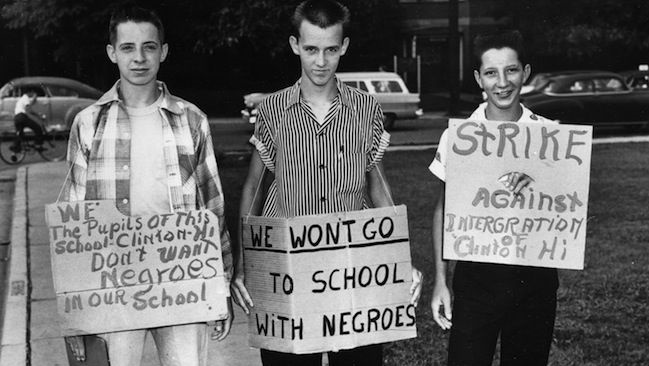

So the story of Obama’s Orwellian plan to counter white flight has been making the rounds lately. Essentially what leftists want to do is make it so that it is impossible for whites within large metropolitan areas to escape the horrible consequences of leftist policies by moving outside of the…

A lot of people seem to peddle get rich quick schemes, and that is just nonsense. It is very unlikely that any scheme that promises to make you a ton of money with low effort and low initial investment will do anything of the sort. If you hear about such…